- Holiday Calendars

- Multiple Location Calendars

- Track a Holiday

- World Holiday List

- Monthly World Holidays

- Mega Millions

- Powerball (US)

- EuroMillions

- India Playwin Thunderball

- UK National Lottery

- Canada Lottery

- South Africa Lottery

- Australia Lottery

- Malaysia Lottery

- News

- Blog

- Latest Draw Results

- Unemployment Rate

- U6 Unemployment Rate

- Euro Zone Unemployment

- Recent Layoffs

- Sector-wise Layoffs

- Monthly Layoffs

- Snapshot

- List - 2011 Failed Banks

- List - 2010 Failed Banks

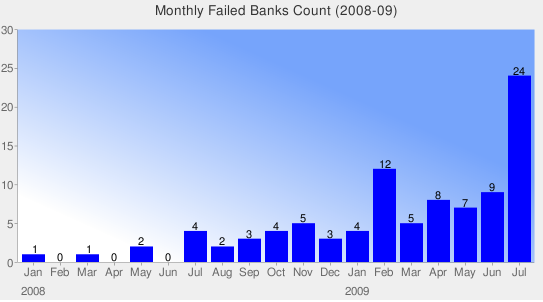

- List - 2009 Failed Banks

- List - 2008 Failed Banks

- Map - 2011 Failed Banks

- Map - 2010 Failed Banks

- Map - 2009 Failed Banks

- Map - 2008 Failed Banks

- FDIC Cost of bank failures

- Map - 2008/09/10 Failed Banks

- Banks Acquiring Failed Banks

- Blog

|

|

| Home | Calendars | Lottery | Timezones | Bank Failures | Employment | HolidaysTracker.com | BanksTracker.com |

| Copyright © 2010 PortalSeven.com | Disclaimer | Privacy Policy |

| This site is best viewed with Internet Explorer 6.0 or higher; Firefox 2.0 or higher at a minimum screen resolution of 1024x768 |